Need Help? Contact Us

Already a subscriber? Login

Subscribe to our RSS

Arbitrator Due Diligence

- The smartest and fastest way to search arbitrators.

- ARBchek distills nearly 55,000 Awards into Summary charts.

- Award summaries display 20+ information fields for easy analysis.

- Awards Plus feature offers relevant content beyond the Award.

New Award Brief

View these summaries of just-released Awards, hot off the press, as well as some selected Awards of interest.

|

UPDATE: ARBchek UA 2026-04 SELECTED AWARDS OF INTEREST |

-

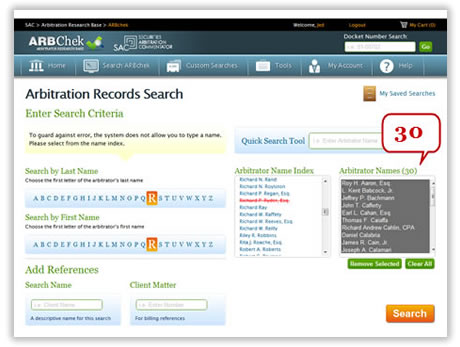

Fast multi-name search engine

Search up to 35 Arbitrators at once and print Awards or summaries for each separately. Read more >

-

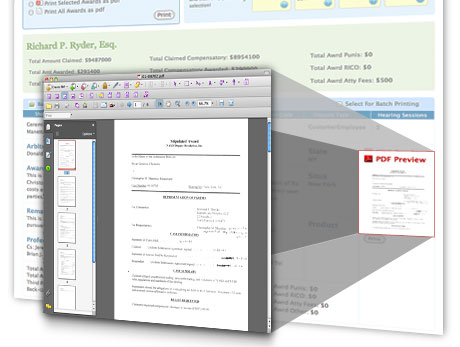

Toggle easily from summary to PDF

Automatically distills Awards data into a Summary format — toggle easily from summary to PDF. Read more >

-

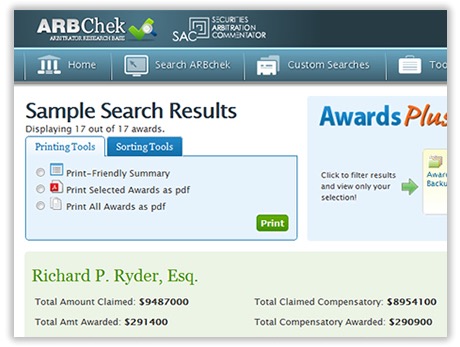

Batch print

multiple AwardsBatch printing allows you to print any number of Awards for an arbitrator all-at-once. Read more >

-

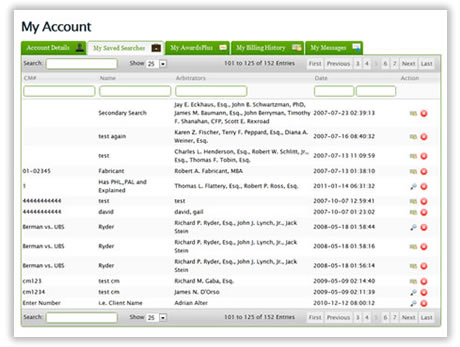

Past searches free

for 120 daysSaved searches are updated for 120 days at no additional cost. Read more >

-

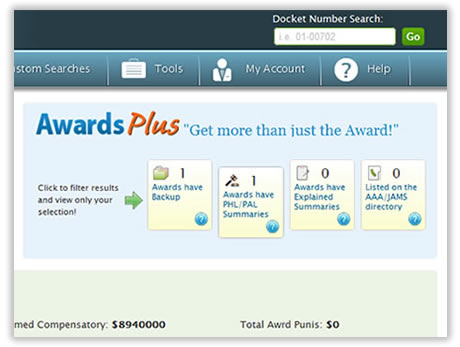

Get more with

Awards PlusWith Awards Plus active, additional options, like requesting the backup, is always just a click away. Read more >

-

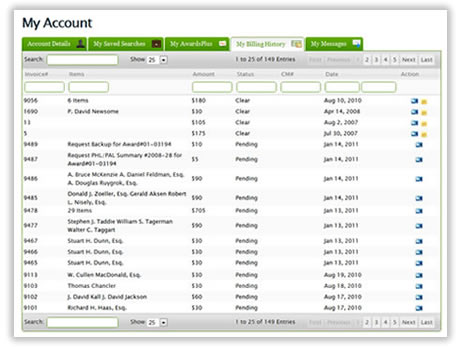

Easy account management

Your account is set up with all of the information you need for easy client chargeback. Read more >